Is the Shortage of Automotive Chips Over?

There are several signs that the shortage of semiconductors for automotive applications has eased. However, production of light-duty vehicles may still be lower than expected until at least 2023.

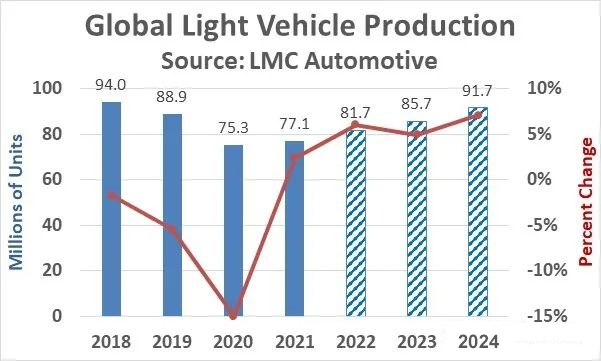

LMC Automotive's July forecast for light vehicle production was 81.7 million in 2022, up 2 percent from 2021. LMC's January forecast was for 13% unit growth, 4 million more units than the current forecast. The July forecast calls for production growth of 5% and 7% in 2023 and 2024. LMC's April forecast for 2023 and 2024 was 4 million vehicles a year higher than its July forecast. Production by 2024 stands at 91.7 million vehicles, but should still be below the pre-pandemic level of 94 million in 2018 five years ago.

The main reasons for the short supply of automotive semiconductors are:

Automakers severely cut semiconductor orders at the start of the COVID-19 pandemic in early 2020. Auto companies fear being trapped in a glut of vehicles if demand plummets due to the pandemic. When automakers try to ramp up orders, they lose their place in the queue, falling behind other industries like PCs and smartphones.

Many automakers use just-in-time ordering systems to avoid excess inventory. This leaves them with little buffer inventory. Additionally, most of the semiconductors used in cars are purchased by the companies that provide the systems (engine controls, dashboard electronics, etc.) rather than the automakers, resulting in a more complex supply chain.

Semiconductors used in automobiles have long design cycles and must be qualified. Therefore, it is difficult for automakers to switch suppliers in the short term.

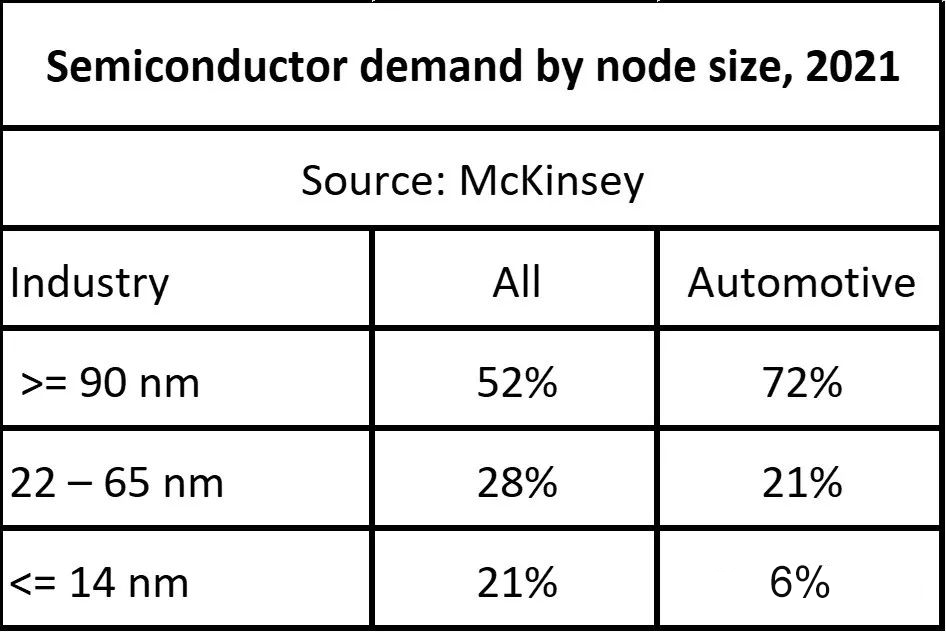

Semiconductors used in automotive applications use older process nodes than most other applications due to long design cycles and long product life. As shown in the table below, McKinsey estimates that by 2021, 72% of automotive semiconductor wafers will use 90nm or more mature process nodes, compared to 52% of all applications. Only 6% of automotive demand is at 14nm and less process nodes, compared to 21% for all applications. Semiconductor manufacturers are concentrating capital expenditures on more advanced process nodes and only modestly expanding capacity at older nodes. Dominant foundry TSMC generates 65% of its revenue from advanced process nodes and only 12% of its revenue from 90nm or larger nodes. Only 5% of TSMC's revenue comes from cars, while smartphones account for 38%.

Given all the factors above, it will take time to resolve all supply issues. Recent comments from major automakers reveal a mixed trend to address semiconductor shortages.

Toyota - No shortage until at least Q3 2022

Volkswagen - Shortage Relief

Modern - Shortage Alleviation

General Motors - Shortage Impact Through 2023

Stellantis – Shortages through the second half of 2022

Honda - uncertain outlook due to shortages

Nissan - recovery in coming months

Ford - shortages still an issue

Mercedes-Benz - no major supply issues

BMW - no production delays due to shortages

Volvo - back to full supply

Bosch (component supplier) - shortage until 2023

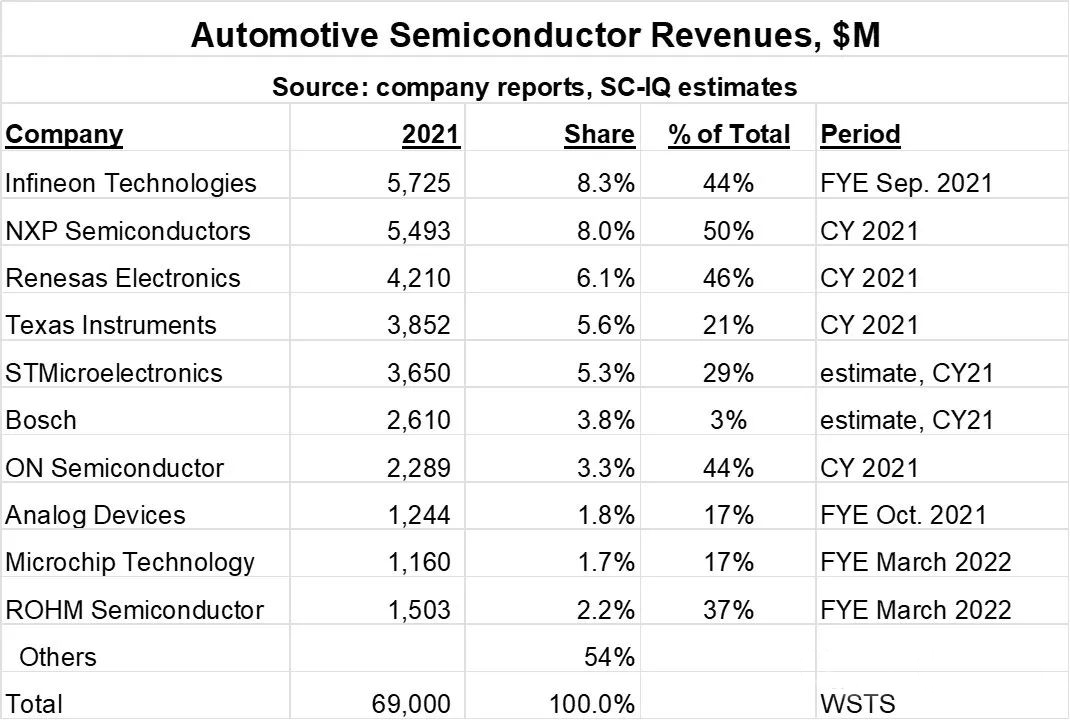

The five largest automotive semiconductor suppliers also took a different view of the outlook for shortages in their most recent financial reports for the second quarter of 2022:

Infineon Technologies - Gradual easing of shortages in 2022

NXP Semiconductors – Demand will still outpace supply in Q3 2022

Renesas Electronics - Inventory returns to planned levels by the end of the second quarter of 2022.

Texas Instruments - Inventories remain below expectations

STMicroelectronics - capacity sold out by 2023

Shortages of automotive semiconductors are likely to continue until at least 2023. While some automakers said they had returned to full production, most reported shortages continuing. Shortages will prevent automakers from producing enough cars to meet demand in 2022 and 2023, resulting in persistently high prices for most vehicles.

Automakers and semiconductor suppliers are working to prevent such severe shortages in the future. Automakers are tweaking their just-in-time inventory models. Automakers are also working more closely with semiconductor suppliers to communicate their short- and long-term needs. Semiconductors will become even more important to automakers as trends in electric vehicles and driver assistance technologies continue.